Last updated on November 11th, 2024

Featured Image: Accidents are bound to happen, but planning ahead with travel insurance may help keep the smile on your face in the event of a mishap / Photo credit: The Visuals You Need on Adobe Stock

You don’t appreciate the value of travel insurance until you need it

by Amanda Burgess

JourneyWomen are seasoned travellers who have circled the globe a time or two. We’ve learned some hard lessons. Life has given us more than our share of challenges and setbacks.

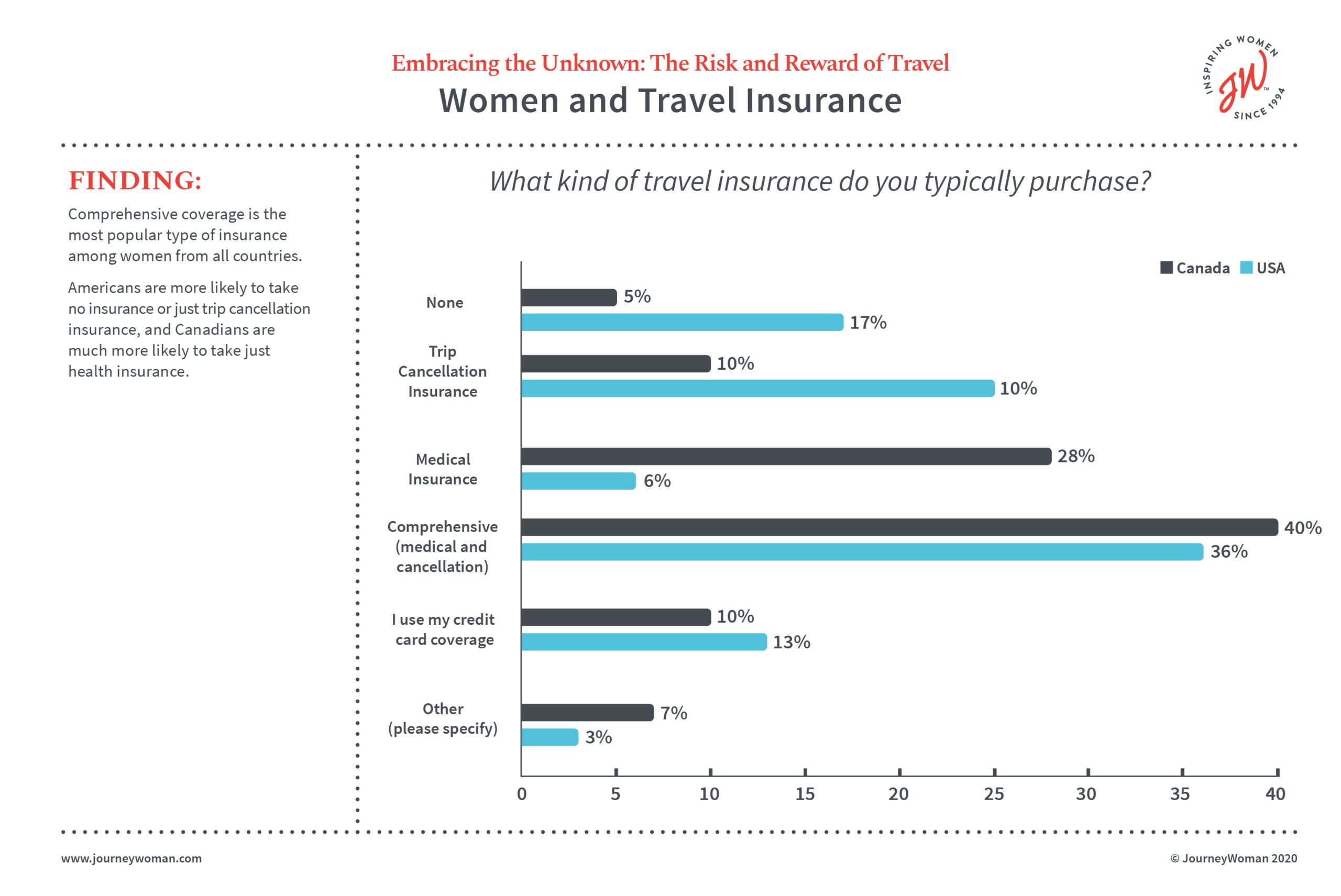

So, it wasn’t surprising to us when the results of our recent global study of 1,500 JourneyWomen – Embracing the Unknown: The Risk and Reward of Travel – showed that the majority of women buy travel insurance.

Pre-pandemic, most women purchased comprehensive coverage. However, there are some differences between the US and Canada. Americans are less likely to buy insurance. Perhaps because they are more risk-adverse, Canadians are more likely to purchase medical insurance than Americans, whereas Americans are more likely to purchase cancellation insurance only.

While data gives you a wealth of insights, personal stories bring context and a human dimension to any issue. That’s why we asked to JourneyWomen everywhere to tell us why you purchase travel insurance, or why you don’t. The times you’ve been caught in a situation overseas without it. And the times where the unexpected happens, you submit a claim and you thank yourself for the foresight of covering yourself with insurance.

Two breaks – one without insurance, and one with

It took breaking a leg while visiting her sister in Norway without insurance 15 years ago to convince Nancy C. that she should never leave home without it. The break didn’t even happen on a grand adventure – she tripped on a rug at her sister’s house. Her sister had to pay for her medical bills, house Nancy and her six-year-old son for two months and pay for new plane tickets home.

“I have tried paying her back over the years, but I learned my lesson. And now over 65 with a few health issues, I’m not willing to chance it,” Nancy says. “I have never made much money, so did everything on the cheap. I usually just managed to scrape together money for the plane tickets. Never dawned on me to buy insurance, even though my dad was in the insurance business. I was 40, pretty healthy, and was taking my son on a European adventure.”

When the incident occurred, Nancy was whisked by ambulance to the local hospital, where she spent half a day receiving treatment. Time was a bit of a blur. Her ankle was broken at two points just above her ankle, and she received a cast that went up to her thigh, severely restricting her mobility.

A closeup of Nancy’s cast and one of the many jigsaw puzzles she completed during her stay / Photo provided by Nancy

While her total costs were not astronomical – about $1,800 with treatment and new flights home – the experience taught her a valuable lesson. “Since that trip, my sister makes sure I have bought travel insurance. I have a little more money now and am 66, so I know how valuable it is.”

Helpful Links from our partners

We only suggest products and services we’ve tried and tested, or that are recommended by our community. Have a partner to suggest or an experience to share? Email us at [email protected].

Willful: Have you been putting off finishing your Will? (Canada)

Willful is a Canadian online estate planning platform that makes it affordable, easy, and convenient to create emergency planning documents in less than 20 minutes – no lawyer required!

Read “Why Estate Planning Should be Part of Your Pre-Travel Checklist” from Willful CEO Erin Bury.

Canadian residents (except Quebec): Use code JW20 for $20 off!

Click here to learn more.

Trust & Will (US Residents)

T&W has helped hundreds of thousands of families create Estate Plans customized to fit their needs, their life, and their legacy.

Trust & Will is offering JourneyWoman a 10% discount using code EXCLUSIVE10. Click here to take advantage of this offer.

TuGo Travel Insurance (Canada only)

Tugo is offering 15 months of travel coverage for the price of 12. Get 3 bonus months included when you buy a Multi Trip Annual travel insurance plan. Learn more about TuGo here.

Not ready to travel yet?

With TuGo, you can buy a Multi-Trip Annual Worldwide Medical plan up to 1 year in advance of your effective date. So, travel when you’re ready!

SafetyWing Nomad Insurance (Global)

SafetyWing offers long-term travel insurance that renews on a monthly basis. Get started here.

Insure My Trip

Compare quotes from various insurance providers to find the best option. Learn more here.

Other articles of interest:

Five Questions to ask your insurance broker before buying Insurance

Buy Travel Insurance That’s Right for You

Travel Medical Insurance: What does your plan cover?

Maria’s Story: Gratitude for Insurance

Maria S. has a similar story – except hers was covered by travel insurance. In 2016, she slipped in a bathtub while in London and broke her hip, which required surgery and an eight-day hospital stay.

It was the first time she’d ever purchased travel insurance. After a close call on a Danube River Cruise where her husband was in the hospital for three days prior to the trip and again immediately after, she decided it was necessary. “We had considered it for the previous trip, but we didn’t realize what travel insurance actually covered. I know I was thinking trip cancellation. Also, I never dreamed that I would be the one who needed it.”

Though the accident was upsetting and her cast unwieldy, Maria is deeply grateful that she purchased insurance – it completely covered all of the physician, hospital and travel expenses to get her home. It even covered an upgrade to business class because she couldn’t bend her knee to fit into a regular seat.

“Sadly, I did not get to enjoy the first-class experience – the flight home was awful! I couldn’t fit into the bathroom because I couldn’t bend my knee very well,” she says. “I always buy comprehensive insurance now. You never know what could happen. There are so many costs involved when you have an injury overseas. The drivers of the ambulance that took me back to Heathrow said that they encountered numerous situations in which the person had to open up several new credit cards to cover all of the expense. It could put somebody in debt for life.”

Maria, upon her return home / Photo provided by Maria

When a last-minute decision to buy travel insurance gives you the support you expect – and more that you never considered

When planning a trip to Sri Lanka in 2006, Sally Jane Smith’s travel agent asked her if she wanted insurance. She dithered over the choice, told the agent she’d think about it and come back to her.

“The decision rested on whether I would take my camera – my most prized possession – on the trip. If I took my camera, I’d take out insurance,” she says. “I took the camera, and the policy. I remember so well looking at that little checkbox. I was travelling on the bare bones of cheap, and the few dollars difference seemed significant. Thank heavens I ticked that box!”

While travelling solo through Sri Lanka, the bus Sally was riding collided with another bus. A third bus stopped, and its passengers poured out to collect the wounded. They carried Sally and others into the third bus and whisked them back to the village where she’d spent the previous night.

“The hospital there was primitive – and has since been replaced by a modern hospital – but its surgical staff were excellent. I had been snacking on cashew nuts just before the collision, so I had to wait for six hours on a gurney in a busy corridor for an operation to remove glass from my body and put a total of 38 stitches into my neck, forehead, knee, and one unlucky finger,” she says. “Thankfully – especially given that I had no MRI or CAT scans done at the village hospital, there wasn’t even a neck brace – my suspected neck injuries turned out to be just whiplash. I say just, but it was incredibly painful, and I was flat on my back for a long time, unable to go to the toilet unassisted for about a week.”

No matter how careful your planning, you can’t have control over every aspect of your trip – travel insurance may be a small part that makes a big impact.

/ Photo credit: sikaraha on Adobe Stock

Through the ordeal, Sally witnessed first-hand the kindness of strangers. A man named Aruna helped her from the village hospital to one of the best private hospitals in Colombo. He contacted her insurance company and made all of the arrangements while she was immobilized in a hospital bed. The insurance company wanted to send an ambulance for her, but since that would add five hours to her ordeal, Aruna convinced the insurer to let him hire a car and driver to bring her to Colombo himself. He even found her a neck support.

“We arrived at the private hospital in the capital in the middle of the night, and the insurance rep, Mrs. Fernando, was waiting for me. She visited me regularly in the hospital, brought me a book to read, organized an optometrist to replace my glasses – he came to my bedside – and dealt with the changes to my travel arrangements, as well as keeping my family informed,” she says. “I was not capable of arranging anything in the condition I was in. Many think that the assistance you get is just about the money, but it is also about someone taking care of bureaucracy when you’re in no state to do it yourself.”

She didn’t pay a cent towards her hospital bills, including one night in the village hospital and eleven days in a private room in Colombo. Insurance covered her new glasses, and three nights in a hotel after she was discharged but not yet cleared to fly.

“They flew in a special nurse and paid for both of us to fly business class from Colombo to Abu Dhabi, where I was living at the time, and for an ambulance transfer from the airport to my flat,” she says. “They also covered the majority of the costs for my sister to fly from Australia to Sri Lanka to the United Arab Emirates and back to Australia to allow Tassin to handle my discharge from the hospital, stay with me in the hotel, fly with me to Abu Dhabi and spend some time with me there to get me settled. It was many weeks before I was able to leave my flat.”

One thing that Sally wants everyone to know is that with her policy, from the moment the ambulance delivered her to her Abu Dhabi flat, the insurance cover ceased. Any follow-up treatment was up to her, so she paid for medical check-ups and having her stitches removed. Now, she recommends not rushing to get home unless you’re covered.

“I don’t know how much money the insurance company expended, but it would have been devastating to me financially if I had to cover it on my own! If I hadn’t had travel insurance, I’d have been stuck in a village hospital without a neck support after my accident,” she says. “To someone who thinks they don’t need travel insurance, I say: Please rethink. Please, please rethink. I know that when one is travelling on a strict budget, every dollar counts, but I cannot stress enough how dire a situation you can land in without travel medical insurance. They don’t only pay the bills – they help you get the care you need.”

It’s hard to believe that an accident could happen while on your dream vacation, but planning ahead can take some of the sting out of mishaps on the road.

/ Designed by Creativepack / Freepik

Shannon never considered insurance, until…

Shannon W. was once among those who never considered travel insurance. It was an added expense she couldn’t afford. When she started travelling solo in 2010, it still wasn’t on her radar. In 2011, when she booked her first guided group tour, they automatically added insurance, which she declined due to cost.

“The first time I purchased travel insurance was when I booked a guided group tour of Prague, Vienna, Budapest and Salzburg that started and ended in Munich. I’m not sure if I purchased the insurance because it was lumped in with the price of the trip, or because I was turning 40 later that year, but I’m glad I did because I wound up in a hospital in Budapest for a week!” she says.

Her tour bus left Munich on May 20, 2013. On the 22nd in Vienna, she felt a twinge in her right leg. By the night of the 23rd, when the group arrived in Budapest, her right leg was swollen and she was in pain. It kept her awake all night. She had a limited international cell phone/data plan, but began Googling her symptoms. The next morning, she could barely walk. Knowing they’d be on the bus for most of the next day, she told her guide she needed to see a doctor – and she was taken to Dr. Rose Medical Center – a private hospital in Budapest favoured by ex-pats.

“I remember the doctor telling me I had two blood clots in my leg and I had two choices – they could immediately admit me to Dr. Rose or they would call an ambulance to take me to one of the national Hungarian hospitals. I chose to stay at Dr. Rose and received the best care. The guide came back to bring my suitcase and complete the paperwork since I was leaving the tour early and then I was on my own,” Shannon says. “The nurses did not speak English and the doctors very little. During business hours, they would bring in someone from the Finance Department who spoke English to translate. We managed to communicate as best we could and everyone was so nice and friendly.”

Her sister handled all communication with her insurer as it was expensive to make international calls with her mobile plan. The insurer would call her in her hospital room and liaise with the hospital’s finance department. She felt supported the entire time – with a single point of contact whose days-off backup knew her case so she wouldn’t have to tell her story again.

“I looked up my receipt, I paid $179 for the travel insurance. My health insurance paid 80% of the hospital stay – and the total for my visit was around $14,000. Travel insurance paid the hospital the additional 20% directly, I was not out of pocket one cent for the hospital stay,” she says. “I was also reimbursed 100% for my three-night hotel stay in Budapest and one night in Munich, all meals, the unused train ticket, the flight from Budapest to Munich and the cost to fly home in business class, per doctor’s instructions. These expenses were out of pocket, but I was reimbursed less than six weeks after returning home. $179 saved me almost $17,000 in unexpected expenses.”

To those who are on the fence about travel insurance, Shannon recommends a bit of research on what insurance covers, doesn’t cover, and the difference between a separate travel insurance policy and what is covered by your credit card.

“Think about your destination and know that hospitals in other countries are not what you are used to at home. I got lucky that my guide knew about a private hospital. I cannot even begin to imagine how different my experience would be in a national Hungarian hospital, alone, upset and scared. Talk to friends and read travel blogs,” she says.

When a cruise doesn’t go swimmingly, but travel insurance offers a life raft

Diane W. and her husband Shelly have purchased travel medical insurance for as long as she can remember. Shelly has a tendency to pick up a bug while they travel, so the insurance has come in handy more than once.

Once on a Caribbean cruise, Shelly had to be treated on board ship, then airlifted off the ship, and helicoptered to another island before being transferred by Medivac to a Fort Lauderdale hospital. “It turned out all right, but the cost of this was significant and the medical help we received was invaluable,” she says. “There were two insurers involved – our work health plan insurer and the insurer for the plan I purchased when I booked our flights – and both were amazingly supportive throughout. That was only the second time that I had ever purchased additional insurance. The cost was peanuts, so I clicked yes – and it really did come in handy.”

The health plan insurer was extremely cooperative and supportive when the ship’s clinic contacted them. They agreed to all of the arrangements for airlifting off the ship and transport to the hospital.

“The bottom line: Shelly was released from hospital a few hours later, we booked into a hotel, slept like a log, then I contacted the insurer to update them and to find out if they would permit us to continue our trip as soon as possible,” she says. “They contacted the hospital very quickly to get the official diagnosis and results of tests, and within a few hours they authorized our return to the ship.”

Getting sick while on board a cruise can have serious – and costly – implications. / Photo by user15145147 on Freepik.com

That’s where the second insurer comes in, because their health plan policy didn’t cover trip interruption costs, but the policy Diane purchased when she booked their flights did. While being airlifted, she spent some time reading that policy to better understand what types of costs would be covered and discovered that it was fairly broad and could possibly cover extra costs such as the return to the ship – and at worst, costs to return home early.

“While waiting for the permission from our health insurer to continue our trip, I was on the phone with the trip interruption insurer to find out what options we had. They quickly confirmed that coverage was there to cover the additional costs to get back to the ship – an overnight stay in Fort Lauderdale, transportation back to the ship, one night in a hotel while waiting for the ship, and meals,” she says. “I had also placed a call to the cruise ship head office to find out how we could get back on the ship — and they were also great. When all was said and done, it took less than a few hours to get the insurers and the cruise line on board, and by evening we were flying to the Cayman Islands to meet our ship and were back on the ship the following day. All of costs except for one of the meals was paid for by insurers, and the majority of the costs were paid by the insurer directly to the service provider.”

It was a massive relief to Diane and Shelly – who really wanted and needed that vacation and would have been disappointed if they’d had to cut it short. They’d have been more disappointed if they didn’t have insurance and had to pay some hefty bills out of pocket. The incident cost approximately US$30,000 ($18,000 for the airlift and transport to hospital, $10,800 in medical costs onboard the ship and in hospital, $1,200 transportation and lodging costs.

“You need to understand the coverage that your credit card insurer provides — are you covered and, if so, to what extent? It all depends on what you can afford and what type of risks that you’re willing to take,” she says. “Whether you believe it can happen to you or not, it does happen. Can you afford all of the medical costs or the interruption/cancellation costs related to a trip?”

When heart issues give the uninsured heartburn abroad

As a resident of the US Virgin Islands, Patsy H. doesn’t qualify for coverage from any of the usual insurance companies – the price paid for living in paradise. When she and her husband retired in 2005, they had the flexibility, if not the funds, to travel as they’d like. They discovered housesitting, and the Gypsy Hirsts were born.

“Our first sit was in Napanee, just outside Toronto. While there, we booked a next sit in New Hampshire, and during that sit nailed one in France! For the next several years, we left our island home early spring, returning late fall,” she says. “I don’t remember that we considered travel insurance for those first few years. We did have some coverage with our American Youth Hostel (Senior) membership, but they stopped offering it when we really needed it.”

That was the year they’d finished their season of house-sits and had moved on to Agde in Southern France to celebrate Patsy’s 70th birthday. They enjoyed a few days along the canal, but Patsy noticed that her husband Jack didn’t seem himself.

Patsy’s husband Jack being tended to by medics in France / Photo provided by Patsy

“Sure enough, his heart was giving problems and we ended up calling the owners of the tiny apartment we’d rented, who came with the medics. They took him to the nearest hospital, in Sete. The wonderful owners took me under their wings, luckily an Irish/American couple, so English speaking. They waited with me at the hospital till early morning hours, only leaving when we were told Jack was stable. I stayed till morning when I could see him, then took a very expensive taxi ride back,” she says.

Patsy has nothing good to say about the French hospital experience. Muddling through on limited French added an extra layer of anxiety to an already stressful situation. Jack had surgery to place a stent in his heart, and a relapse sent him back to the hospital one more time before their train through Spain and Portugal en route to their cruise home. The experience sent Patsy off in search for travel insurance coverage.

“With both age and location against us, I found the Schengen information for those getting Schengen visas. I was able to get just the insurance part before we traveled to Europe next time. Lots of paperwork, of course, but they did pay up when needed,” she says.

The bottom line

Travel insurance is a necessary evil. An added expense that guards against astronomical costs when the unexpected occurs. Which it does with greater regularity than many assume, regardless of age.

Before dismissing the idea of insurance, do your due diligence. Read policies and contracts before you buy. Research your destination’s health care system to determine how they handle services for foreign visitors. Determine how much you can afford to lose if you find yourself in an emergency situation. If the cost of travel insurance gives you heartburn, consider these stories as cautionary tales.

Read More on Staying Safe While Travelling

When Something Goes Wrong: What to Do if You’re Injured While Travelling

Anything can happen on a vacation. Here are some first-hand tips for women to plan for an unexpected injury.

JourneyWoman Webinar: Women’s Safety and Cybersecurity on November 19, 2024

Join our panel of experts on November 19 to learn how to protect yourself against cybersecurity at home and while traveling.

Planning for an Emergency During Travel: Safety Tips for Earthquakes, Forest Fires and More

Unpredictable weather patterns mean that women need to be prepared for natural disasters, from forest fires to earthquakes.

My friend on the third day of a cruise from Santiago to LA had a heart attack. He survived and was let off the ship in Lima and hospitalized. After four days his family decided to Med Vac him to Kaiser Hollywood where he had heart surgery. He is fine now. Med Vac required a pre payment of $97,000.

Whoaaaaa. That’s crazy, Margaret!

Re Insurance; I booked a Road Scholar cruise and paid $700 for Aon insurance at the same time that I purchased the trip, 18 months ahead of the trip. Due to political instability in the area months later, I decided it wasn’t prudent to travel so I cancelled the trip. While Road Scholar gave me a credit for my down payment, I lost $700 as my reason for cancelling did not fit Aon’s guidelines for refund. RS and Aon were not willing to transfer the funds to another trip. I felt like a non profit company had contracted decision making out to a for profit company. When I’ve traveled with other providers, I purchased the travel insurance and never had a problem if the trip had to be changed. I

I’m surprised Patsy H’s husband could get insurance as his heart condition would have been a pre existing condition and is usually excluded from the policy.

In 2016 I travelled alone to Italy. I had remission from leukaemia 6 months earlier. I had travel insurance but it excluded any pre existing conditions, which you must declare. It’s surprising how many injuries and illnesses have happened over a lifetime. I declared type II diabetes, a broken wrist years earlier, a back injury again years old, and of course, the leukaemia. The result was interesting. The Type II diabetes was covered as it was well managed over many years. The wrist was covered. The lower injured part of the back was not covered, but the upper back was. The leukaemia? No, but it will be in 5 years of remission.

Also, I researched and found that Italy had reciprocal rights with Australia for medical. I got sick in Venice on my own. I took a boat to Venice hospital, saw a skin specialist, got medication for a severe rash on my legs, all free of charge. I had to show my passport and Medicare card (an Australian government issued medical card). I went to the hospital as I was told someone would speak English there whereas a local doctor may not.. So I didn’t use my travel insurance and it would not have covered the rash anyway. I was so grateful I had done my research before leaving Australia and knew that Italy had reciprocal medical. I had excellent care. It’s scary when you are sick and alone.

Then in 2019 I again travelled alone to Italy and France. The credit card insurance that I had used in 2016 had changed underwriters. I again did the pre existing insurance declaration. The result was that the new insurer excluded every one of my pre existing conditions! That was good to know. That insurance cover would have been useless to me.

So I used the 2016 company and bought a stand alone policy. The insurer was much more generous now and had less exclusions. It cost me $600 Australian for 6 weeks cover. I offset this by suspending my private health insurance, while out of Australia. Result? I was $200 out of pocket.

So go over your travel insurance policy carefully before you leave home, so there are no nasty surprises if you do get I’ll or injured. Enjoy the journey.

Is it possible to publish a list of the highest rated travel/accident insurers, i.e. those that have really good cancellation policies for all types of situations and pay for all types of accidents?

Great idea! We’re on it!

I will be interested in this webinar on travel insurance in October. I have always purchased travel insurance (cancellation and medical) but never had to make a claim until this year. I had a trip planned to Newfoundland in June which, due to Covid 19 was cancelled. I waited until the airline (WestJet) and the land agent provided notices of cancellation before making a claim. I could not claim for the airfare portion as WestJet provided a credit so I submitted a claim only for the deposit on the land portion. The claim was submitted in March. Along with the claim form I sent a cancellation invoice which clearly stated that no refund would be issued. In July I received an email that I would not be paid out for my claim as I “may receive a credit”. I launched an appeal and I am still waiting for a response. I have been reading about many other people caught in this same situation, most of them claiming for far more money than I am. My takeaway from this is that you can read the fine print on your policy but ultimately the insurance company will interpret the policy however they like and will or will not pay on that basis. The travel insurance industry needs a complete review and overhaul.

My girl friend broke her hip on a cruise. The ship let her off n the Canary Islands where she had hip surgery and stayed for seven days. Her roommate /advocate stayed in a hotel. Afterwards they flew to Barcelona and then first class back to the USA. Both received a voucher to take the same cruise the next year. She had no insurance. The cruise line paid for everything.

Thank you for this article. I have never purchased travel insurance before, but from now on I will definitely do more research and make sure I’m covered!

An interesting eye opener. In all my years of travel I have never taken out insurance.

Maybe its will happen next time i travel.

My bravado these days seems to be dwindling .