Last updated on April 19th, 2024

How to save money and convert multiple currencies while travelling

by Carolyn Ray

Welcome to our Travel Technology column, where I attempt to answer your questions about the mystifying, ever-changing and evolving world of technology. Having spent years working in the technology industry with IBM and other notable firms, I have always been an early adopter and feel qualified to share my personal experiences or find those who know more than me, which often includes our readers. I always encourage you to review other sources and consult with experts.

Topic of the week: Prepaid travel credit cards

One of the most frequent questions on our private Solo Travel Wisdom group is about prepaid travel credit cards.

Question: “Does anyone have experience with a Wise card? How are the exchange rates going from Canadian dollars to other currencies? Thank you for any guidance you can give me.” — Cheryl T.

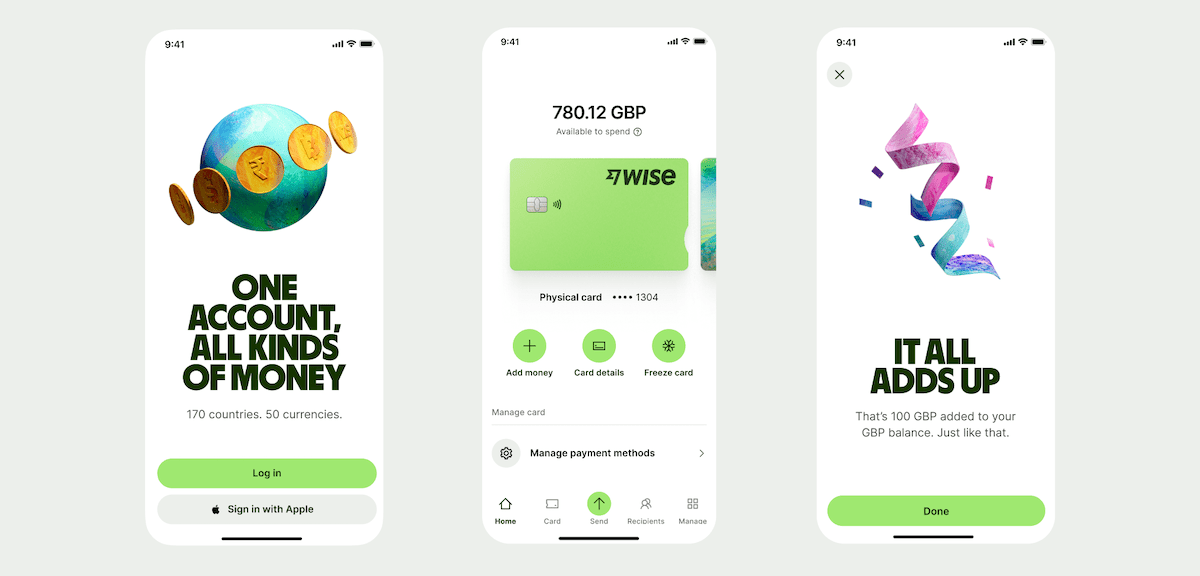

My take: I much prefer having a digital card like Wise on my phone versus pulling my credit card out of my wallet when I want to pay for public transit or make payments at stores and restaurants. In most European countries, you can tap on and off public transportation, such as the metro, subway, or bus with your phone using your Wallet (on iPhone) which uses facial recognition for additional protection.The other feature I enjoy is currency exchange, which can be done at the touch of a button for a small fee. For example, if I am travelling to Switzerland and don’t have Swiss Francs, I can convert my Euros into this currency at the touch of a button, and then convert unused funds into a currency I need. As a business owner, I use Wise to make payments in different currencies and have found the fees significantly lower than Paypal. Wise also has a plastic credit card as well but I just use the digital one.

Editorial note: JourneyWoman may earn revenue from this article from the company mentioned if you choose to purchase their product, but there is no cost to you for this. Our perspective is informed by our readers and our personal experiences, not influenced by advertisers. We wouldn’t recommend a product we haven’t used ourselves and will state if an article of this type is paid for or sponsored by a company, which it is not in this case. Read our disclaimer here.

What is a prepaid travel card?

A travel money card, also called a currency card, is a type of card which allows you to keep multiple currencies and use the card while travelling the world with no hidden fees to worry about.

Two of the most popular brands are Wise (formerly TransferWise), based in the UK, and Revolut, which is used more in Europe. Both Wise and Revolut can be used to send and receive money all over the world. They come with their own debit cards and offer cheaper currency conversions and money transfers than regular banks. For the purposes of this article, we’re covering Wise as it’s the one I’ve used for the past two years.

Benefits of a prepaid travel card

Prepaid cards like Wise offer several benefits over physical credit cards, including no foreign transaction fees and lower rates than traditional credit cards.

Exchange rates: Both Revolut and Wise use the mid-market exchange rate, which is much better than the rate we might get at a bank, which also charges hidden fees. One difference with Revolut is that there is an extra 1.0% fee if you’d like to move RUB, THB or UAH. Revolut also charges a fee outside exchange hours, which can range between 0.5% – 2.0%.

One of the features I like about Wise is that they send you alerts when exchange rates are higher, particularly important to those of us in Canada who have to be thrifty when travelling abroad. This means you can load up your wallet when exchange rates are higher, even before you travel.

Sending money: Fees vary slightly when sending money depending on the source of the funding. For example, if you’re funding your Wise account from your bank account, there is an Interac fee. I use Wise for business so the fees may be slightly higher than on personal accounts.

Receiving money: There is no charge to receive non-wire money on Wise. There is a fixed fee depending on the amount for SWIFT or wire transactions, between $4 and $10.

Pricing: With Wise, the digital card is free. There is also a plastic card which costs $6. Revolut has different account levels — the entry-level account is free but then costs go up to $45 a month depending on the package. Revolut offers a broader range of services including travel perks and investments.

What women say about Wise and prepaid travel credit cards

“Wise is an amazing resource. If you get the debit card, you can transfer money into a local currency account and use the debit card to withdraw it when in the country. You save a LOT on fees and currency conversion charges. — Mariellen W.

“Reminder to check which credit cards don’t have international fees. I forgot all about it this last trip & boy did those fees add up.” — MaKoa N.

“I have (a Wise card). I can’t really speak to your question about exchange rates but I have found it to be a great way to carry money internationally. It’s easy to load money onto it. It’s not connected to my own bank account so the risk of losing it is less damaging. It’s widely accepted so less need to carry anything else. I have nothing but positive experiences with it.” — Nancy T.

“I have Wise and I totally love it. You can go on their website and see that day’s exchange rate I believe. What you are not paying with this card is the 2 to 3% above that rate that bank cards charge to do a foreign transaction!!” — Cathi W.

“I used Wise to transfer money to an overseas vendor to pay for a trip in their currency. The exchange rate and service fees were less than using my credit card. It was easy once I read through the steps and provided confirmation of the transaction and delivery of the funds. I continue to weigh the savings vs credit card use (not accumulating points and insurance).” — Helen C.

“I also use Wise as a way to receive money from retreat participants in the currency of their choice and so that I can easily and seamlessly move through countries and access that same currency, having never paid exchange rates. I will caution anyone who holds large amounts (50K+) in any digital service, however. They are not a bank, and while highly regulated are not under the same protection as an institution.” — Tania C.

Please note: We make every effort to provide accurate and up-to-date information. While we may highlight certain positives of a finanical product, there is no guarantee that readers will benefit from the product. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by JourneyWoman. Read more in our Terms of Use of this site.

Learn More About Travel Technology

Travel Technology: What is a VPN or Virtual Private Network?

Our Travel Technology series answers the question: ‘what is a VPN’, to help you protect your privacy on public networks.

Travel Technology: What is an eSIM or Electronic Sim Card for Mobile Phones?

Our Travel Technology series starts with a look at eSIMs, a new, cost-effective way for women to save money and stay connected on mobile phones.

Hold The Phone, Grandma: Safe Etiquette for Grandkid Holiday Snaps and Social Media

Suggestions for grandparents when posting holiday photos on social media, particularly when traveling with grandchildren.

0 Comments

We always strive to use real photos from our own adventures, provided by the guest writer or from our personal travels. However, in some cases, due to photo quality, we must use stock photography. If you have any questions about the photography please let us know.

Disclaimer: We are so happy that you are checking out this page right now! We only recommend things that are suggested by our community, or through our own experience, that we believe will be helpful and practical for you. Some of our pages contain links, which means we’re part of an affiliate program for the product being mentioned. Should you decide to purchase a product using a link from on our site, JourneyWoman may earn a small commission from the retailer, which helps us maintain our beautiful website. JourneyWoman is an Amazon Associate and earns from qualifying purchases. Thank you!

We want to hear what you think about this article, and we welcome any updates or changes to improve it. You can comment below, or send an email to us at [email protected].